Close

Three school friends found the first company starting with a capital of €4,800. The operational headquarters is a basement on the outskirts of Rome. In its embryonic stage, UNDO is an engineering-based company in the field of energy efficiency. The first orders, in fact, are installations of window frames and solar thermal panels.

UNDO Adunanza s.r.l., to all intents and purposes the pioneer company of the Group, is born. The society settles in Villa Adriana in Tivoli.

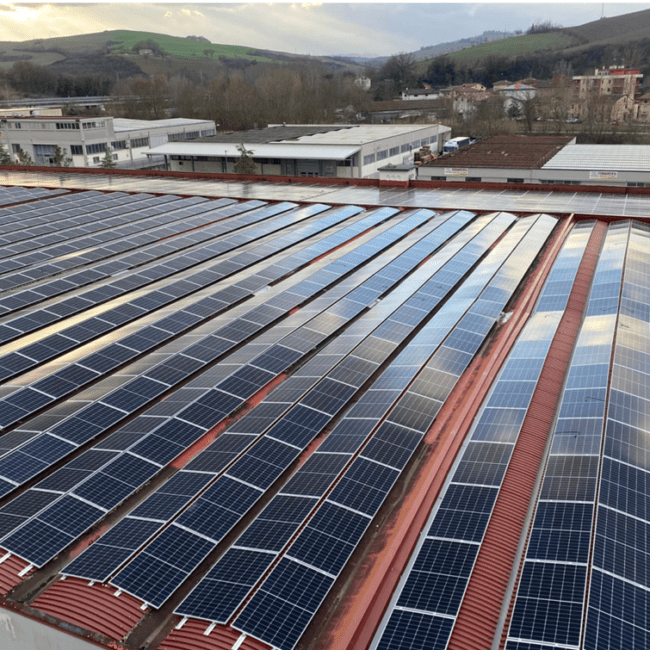

UNDO can finally count on a first owned 20 kWp plant. Cellula is established and the sales network is born. In the same year, the first proprietary 50 kWp energy-only plant was built, the company received its first large order (100KWp and €500,000) and worked on its first Industrial Plant. The sales network for domestic installations is born, and finally UNDO extends its capabilities to the air conditioning sector.

The number of owned facilities continues to grow. During this year it will come to 11 for about 1 MWp. In 2012 Undo closes with Production Value over 6 M. A new investment strategy in the field of self-building for PV systems in the primary sector is grounded. In 2012 Undo closes with Production Value over 6 M.

UNDO Adunanza changed from being an S.r.l. to an S.p.A. This period also saw the first M&A (Mergers & Acquisition) transaction on the Secondary Market with bank Iccrea. At the same time, construction work is completed on another 8 owned plants for 720 kWp. The company also further extends its capabilities in O&M (Operations & Maintenance).

UNDO starts and completes the construction of 2 plants with a capacity of 160 kWp (Danteflex). It is a watershed year: the core business becomes industrial plant construction and the secondary market while activities pertaining to the domestic and air conditioning sectors are discontinued.

Development on the primary photovoltaic front begins, and UNDO’s activities extend to the mechanical sector as well.

Change the structure of the company. The demerger of Undo Adunanza S.p.A. takes place and Madre Holding S.p.A. is founded.

The new Holding Company for Greenfield, Ancora Holding s.r.l., is founded and the new production plant is purchased.

UNDO is included in Borsa Italiana’s ELITE program and adopts a code of ethics and an organizational model pursuant to Legislative Decree. 231/2001.

Through a bridge loan provided by MPS Capital Service of about 15million, the Group acquires new photovoltaic plants. In the same year, bond issues of EUR 4.5 million underwritten by Anthilia SGR are published. In the field of wind and photovoltaics, the company can count on two Project Financing with Iccrea Bank for about 5 million euros. UNDO plant capacity grows by 6.5 MWp.

The Agricultural Society is founded, and the capacity of the plants increases again by 3.8 MWp. A new €3 million bond issue is published. Through the RES1 incentive program, a new photovoltaic plant of about 20 MWp is developed. The company acquires, renovates, and expands new facilities of about 10,000 square meters into which it moves its operations.

A Project Financing of 70% of the group’s plant fleet is finalized, with a 33 M Unicredit and MPS CS pool transaction.

UNDO Group is turning 15 years old. With more than 80 photovoltaic and wind power plants owned and under management – for a capacity of olter 32 MWp and 250 MWp of developments, many companies covering the entire renewable energy supply chain, and a team of more than 90 people, it looks forward to the new challenges that the future offers it.

Three school friends founded the first company starting with a capital of €4,800. The operational headquarters is a basement on the outskirts of Rome. In its embryonic stage, UNDO is an engineering-based company in the field of energy efficiency. The first orders, in fact, are installations of window frames and solar thermal panels.

UNDO Adunanza s.r.l., to all intents and purposes the pioneer company of the Group, is born. The society settles in Villa Adriana in Tivoli.

UNDO can finally count on a first owned 20 kWp plant. Cellula is established and the sales network is born. In the same year, the first proprietary 50 kWp energy-only plant was built, the company received its first large order (100KWp and €500,000) and worked on its first Industrial Plant. The sales network for domestic installations is born, and finally UNDO extends its capabilities to the air conditioning sector.

The number of owned facilities continues to grow. During this year it will come to 11 for about 1 MWp. In 2012 Undo closes with Production Value over 6 M. A new investment strategy in the field of self-building for PV systems in the primary sector is grounded.

UNDO Adunanza changed from being an S.r.l. to an S.p.A. This period also saw the first M&A (Mergers & Acquisition) transaction on the Secondary Market with bank Iccrea. At the same time, construction work is completed on another 8 owned plants for 720 kWp. The company also further extends its capabilities in O&M (Operations & Maintenance).

It is a watershed year: the core business becomes industrial plant construction and the secondary market while activities pertaining to the domestic and air conditioning sectors are discontinued.

Development on the primary photovoltaic front begins, and UNDO’s activities extend to the precision mechanical sector as well.

Change the structure of the company. The demerger of Undo Adunanza S.p.A. takes place and Madre Holding S.p.A. is founded.

The new Holding Company for Greenfield, Ancora Holding s.r.l., is founded and the new production plant is purchased.

UNDO is included in Borsa Italiana’s ELITE program and adopts a code of ethics and an organizational model pursuant to Legislative Decree. 231/2001. Issuance of two bonds worth € 4 million underwritten by Zenith SGR, Iccrea and Banca Popolare del Lazio

Through a bridge loan provided by MPS Capital Service of about 15million, the Group acquires new photovoltaic plants. In the same year, bond issues of EUR 4.5 million underwritten by Anthilia SGR are published. In the field of wind and photovoltaics, the company can count on two Project Financing with Iccrea Bank. UNDO plant capacity grows by 6.5 MWp

The Agricultural Firm is founded, and the capacity of the plants increases again by 3.8 MWp. The company acquires, renovates, and expands new facilities of about 50 Ha into which it moves its operations. Issuance of bond worth € 3 million underwritten by Iccrea Blu Banca

A Project Financing of 70% of the group’s plant fleet is finalized, with a 33 M Unicredit and MPS CS pool transaction.

In February 2023, Undo Group announced that Axiom Group Limited entered with the largest share in the UNDO the capital. This transaction allowed UNDO Group to reach another dimension of market players. UNDO Group is turning 15 years old. With more than 80 photovoltaic and wind power plants owned – for a capacity of olter 32 MW and 250 MW of developments, and a team of more than 40 people, it looks forward to the new challenges that the future offers it.

Issuance of bond worth € 25 million underwritten by Anthilia SGR, Tenax Capital, BCC Banca Iccrea and BCC Colli Albani. Successfully finalized a €114 million Project Finance agreement with BPER Banca, Unicredit, MCC, and MPS. The financing is aimed at refinancing existing debt and supporting the development of new photovoltaic plants. This milestone represents the most significant financial operation in the Group's history, highlighting the strength of its projects and the financial market's trust in the renewable energy sector. This achievement forms part of a broader success story, as Gruppo Undo completed financing operations totaling €155 million in 2024, further reinforcing the financial market's confidence in the Group.

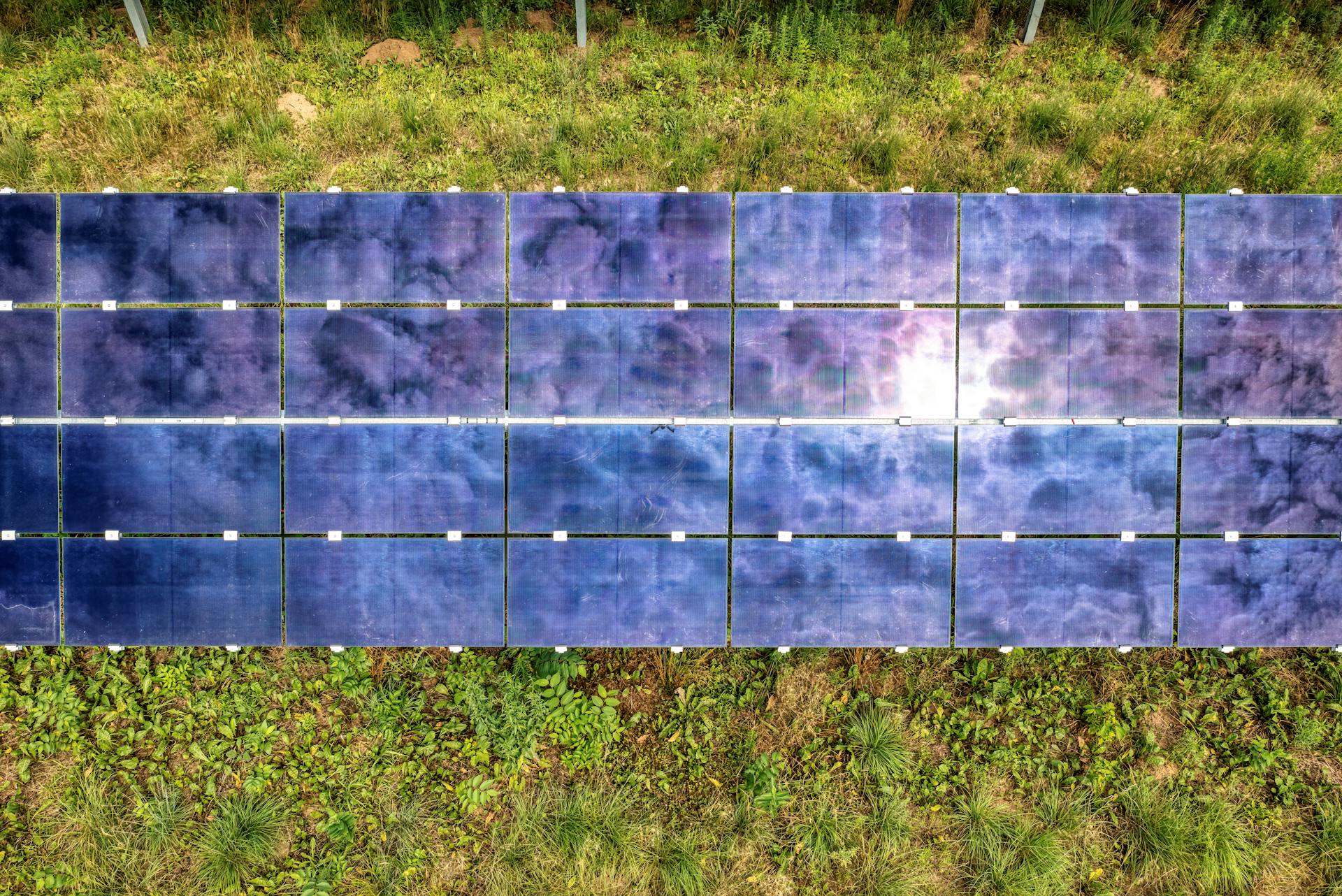

Empowering a sustainable future by producing solar energy to reduce our carbon footprint and promote renewable energy adoption. Our mission is fostering a greener and more resilient world for generations to come

We dream of a world where everyone has access to clean, sustainable energy, reducing our dependence on limited resources and ensuring a brighter future for generations to come.

We believe that the most effective solutions only come from collaboration and co-creation with the people closest to the challenges.

We collaborate – in fact – with partners who share our desire to seek new opportunities that bring value to our shareholders.